Are you looking to take out a home loan but unsure of the potential financial pitfalls? Taking out a home loan is an important decision that requires careful consideration. Here are some essential tips for taking out a home loan and avoiding costly mistakes.

Firstly, do your research on different lenders and compare interest rates – this could save you thousands in the long run. Secondly, consider all other costs associated with taking out a loan such as legal fees or mortgage insurance.

Thirdly, make sure you understand what type of repayment plan suits your lifestyle best so that it’s easy to keep up with payments each month without getting into debt trouble. Finally, be aware of any penalties or additional charges if you don’t abide by the terms of your agreement.

By following these simple steps when taking out a home loan, you can enjoy the benefits of homeownership without falling into financial difficulties down the line.

Research the Loan Options Available

Researching loan options available when taking out a home loan is essential for avoiding financial pitfalls and managing debt correctly. Comparing interest rates, fees, and repayment terms of different lenders can save you money in the long run.

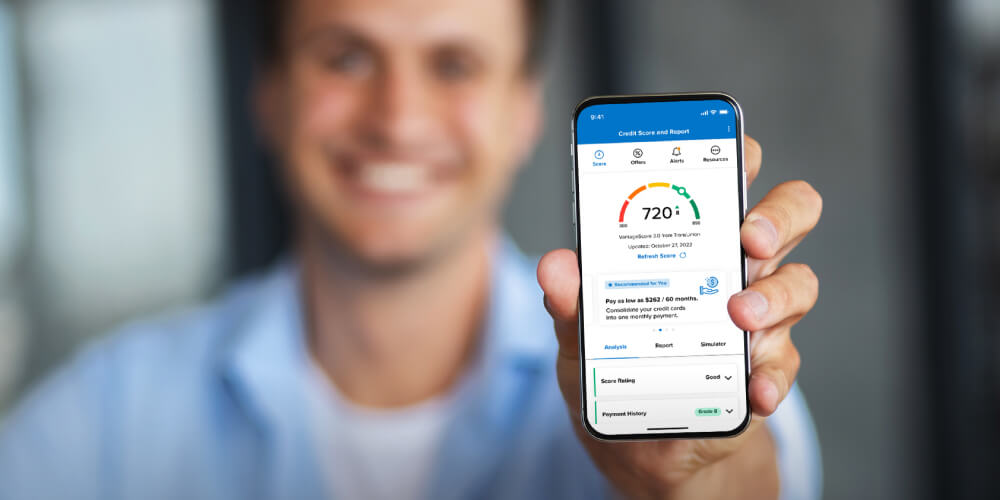

Knowing your credit score is also important to determine which loans you are eligible for and if any additional collateral may be required. You should also consider researching government-backed home loan programs that offer low or no down payments.

It’s essential to know what kind of agreement a lender offers before signing on the dotted line – understanding all the details can help you make an informed decision and avoid getting into debt over your head. To ensure you get the best deal possible, take some time to research multiple lenders and compare their offerings side by side.

This will give you a better idea of who has the most competitive rates and terms so that you can make an educated decision about which home loan option is right for you!

Build Up Your Credit Score to Get Better Rates & Terms on Loans

One of the most important factors to consider when taking out a home loan is your credit score. A good credit score can help get you better terms and rates on loans, but if your credit history is not in order it could mean higher interest rates or even being denied for a loan altogether.

To build up your credit score ahead of applying for a home loan, there are several steps you should take:

1. Check Your Credit Report: It’s essential to review your credit report before applying for any type of loan. You can request a free copy of your report from each of the three major bureaus once every 12 months. This will allow you to check for errors and fraudulent activity that may be bringing down your score without you realizing it so that they can be disputed and removed from the record if necessary.

2. Pay Your Bills On Time: Making sure all bills are paid on time is one way to improve your credit rating quickly; late payments have an especially negative effect on scores, so make sure never to miss payment deadlines whenever possible. You might also want to set up automatic payments through online banking which makes paying bills easier – just make sure funds are available in the account at all times!

3. Keep Balances Low & Limit New Credit Inquiries: High balances relative to spending limits as well as too many open accounts or new requests for lines of credit will hurt your overall rating since this suggests less financial responsibility than lenders like to see when considering applicants for large loans such as mortgages – try keeping balances low (around 30% or lower) and avoid opening new accounts unless necessary before application date!

Conclusion

Taking out a home loan is an exciting and sometimes overwhelming process. The key to managing debt responsibly and avoiding financial pitfalls is to do your research, be aware of the risks associated with borrowing money, and plan.

Understanding all aspects of the loan process can help you make informed decisions that are in line with your budgeting goals. Be sure to compare rates from multiple lenders before deciding on a mortgage product, as this will ensure that you get the best possible deal for your situation.

Additionally, pay close attention to closing costs so there are no surprises when it comes time for repayment. Finally, always factor in extra expenses such as property taxes into your monthly payments so that your overall debt load remains manageable over time.

By following these essential tips for taking out a home loan and avoiding financial pitfalls, you can ensure that your decision puts you on the path toward achieving long-term financial success.