Table of Contents

Running a business is not an easy task. You can ask an entrepreneur about it. They will never say it is a piece of cake. It is so because a business involves various processes for which the services of a specialized individual or group of individuals need to be hired. If you go on performing every job by yourself, you will surely make a blunder.

Business owners usually hire the service of trained professionals to carry out every job because they don’t have the time and energy to invest in correcting mistakes. The more time they spend fixing the errors that could have been performed well by a professional, the less time they are left with on growing their business.

Paystub is a critical element of a business, as it includes all the important details concerning the pay of a staff member. A person specially trained for the purpose carries the job of creating paystubs and payroll out, who ensures that the process flows smoothly like oxygen in an organization. However, if it is not performed properly because of incomplete documents or other reasons, it has a poor impact on the firm’s image.

So, this article will discuss the common mistakes to avoid as a business owner when generating paystubs. You may also generate high-quality paystubs online for yourself and your employees.

1. Difference Between Current Period & Year-to-year Data

When building paystubs for yourself or your employees, it is crucial to understand the difference between the current duration and year-to-year data. To avoid trouble it is helpful to label all the information accurately. If you cannot label each dollar amount rightly, it will confuse your staff, and blunders will occur.

Every firm should organize a training program to teach their employees the difference between the current duration and year-to-year data. It might not seem vital at the moment, but at the time of creating the paystub, it will come in handy. This information also assists your employees in finding out if their tax withholdings, gross wages, and benefit contributions are on the right track.

2. Learning the Importance of Following a Proper Pay Cycle

As a business owner, you understand that your employees have a life of their own. If you keep them from enjoying it or offer an inadequate salary or limited perks, it may create havoc in the future. So, always give them enough freedom to plan things, especially their finances.

Sometimes a company may also withhold the autonomy of an employee by keeping the details regarding their pay cycles hidden from them. If you don’t want to make such a blunder and waste a significant amount of time fixing it, we suggest updating your pay cycle and including all the details in it.

Such critical details include your salary date and how frequently your payment is processed. It may be weekly, bi-weekly, or even monthly. So, while making paystubs as an employer, keep in mind to clearly state the above information.

3. Providing Correct Tax Information to Avoid Any Penalty

As an employer, you know that federal and state tax laws change constantly. It is not surprising to hear a new modification introduced to these laws every week. A paystub must also update as it includes withholdings based on current tax laws. Any mistake may lead to a severe blunder in the future, which may consume a lot of your precious time and energy.

If the withholdings included in your paystub are incorrect, your employees may have to pay for an unexpected tax liability at the end of the year. It is also possible they may have to bear the burden of penalties for underpayment of taxes. So, always keep in mind to generate accurate paystubs using the updated technology and information.

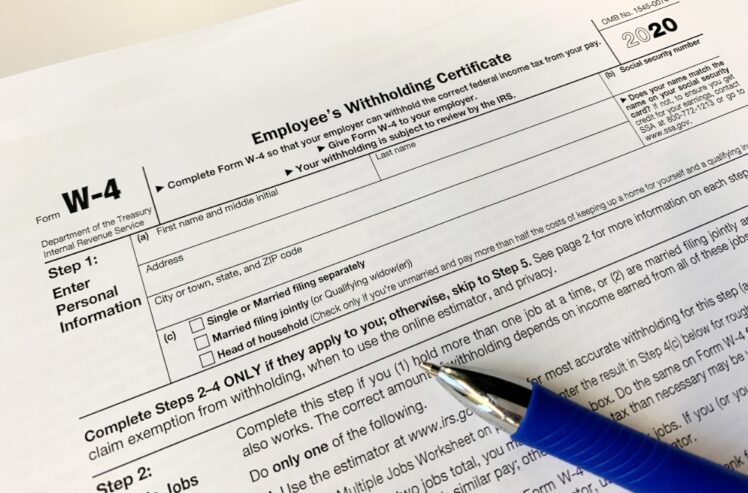

4. Always Updating the Information Contained in Form W-4

Before understanding why it is essential to keep updating the information in Form W-4 we must learn what it is. Also known as Employee’s Withholding Allowance Certificate, Form W-4 is a form issued by the federal government in the name of the newly appointed employees. The government requires such employees to fill out their information on this form.

The information filled out in this document lets the employers know the amount of salary they can withhold from a paycheck for tax. As a staff member, you must provide the updated details to your employer. And as an employer, you must maintain an updated record of your staff’s current W-4 form in their payroll file. It is so because the IRS may ask you to submit a copy of the document.

You must add an accurate number of allowances into the payroll processing system to ensure a smooth workflow. The worker information included in the W-4 form includes their address, name, and filing status. Besides, it also contains guidance for those staff members with working spouses and multiple jobs.

It is essential to include these details for calculating withholdings through these extra resources. Now that you know how crucial this data is to an employer, you must understand if they have an outdated record of it, it may create a blunder.

If you aspire to process payroll correctly, ask your employees to update their details according to the modifications in their tax withholdings, based on their marital status, parenthood, and salary. To achieve the purpose, you may adopt an automated system that helps keep mistakes at bay.

Parting Words

If you are new to creating paystubs as an employer, we must tell you it is not a hectic task at all. The only thing you must keep in mind when drafting a paystub is staying updated on the recent trends and laws entailing it. It is so because paystubs provide vital details regarding the tax withholdings, wages, and benefits of the employees.

It is also helpful to the employees when applying for loans and as proof of their income. We truly hope you learn something from the above four common mistakes and do not repeat them while generating your paystub. We wish you all the best.